Menu

Stochastic dominance and portfolio choice (CAC 40)

Academic project · CY Tech · January 2026

Objective: Empirically test whether equity portfolios built from CAC 40 constituents can stochastically dominate a CAC 40 tracker, using daily returns (2015–2025).

- Daily price data (2015–2025) via yfinance and return construction.

- Random generation of long-only portfolios (static buy-and-hold weights).

- Nonparametric stochastic dominance tests (orders 1 and 2) with bootstrap p-values (PySDTest).

- Year-by-year dominance matrices and temporal stability.

- Ex post evaluation in year t+1: Sharpe, VaR, skewness, kurtosis.

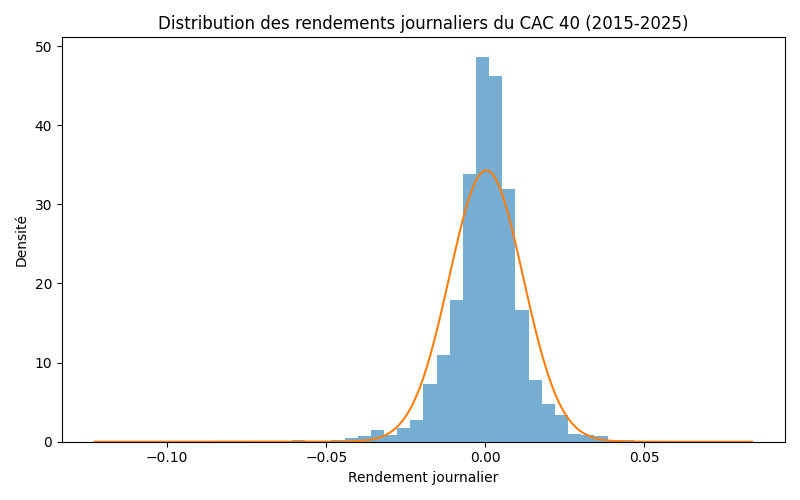

CAC 40 daily returns distribution (2015–2025): visible departure from normality motivates distribution-based comparisons.

Beyond the standard mean–variance framework, this project compares portfolios using the full return distribution. Stochastic dominance provides a nonparametric ranking: first-order dominance is compatible with all investors with increasing utility, while second-order dominance corresponds to risk-averse preferences (increasing and concave utility).

Dominance relations are tested year by year using bootstrap-based statistical tests, and we also check whether dominance detected in year t is associated with improved performance in year t+1.

If the preview does not display correctly, please use “Open PDF”.